Introduction

Global car markets are changing due to the electric vehicle (EV) revolution, and Tesla is leading the way. India’s fast expanding economy and environmental objectives offer a compelling opportunity for the corporation looking to expand. Tesla India Market Research-This blog explores market factors, obstacles, and strategic avenues as it delves deeply into Tesla’s possibilities in India.

Why India? The Charm of a Vast Unexplored Market-Tesla India Market Research

We expect the EV market in India to expand rapidly. The need for sustainable transportation solutions is growing due to the world’s population, which is over 1.4 billion, and increasing urbanization. By 2030, 30% EV penetration is the goal of government programs like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) plan.

Tesla’s arrival might capitalize on this momentum. But compared to the U.S. or Europe, the market is completely unique. Success will be determined by charging infrastructure, regional manufacture, and reasonable prices. For example, Tesla hasn’t yet ventured into the sub-$20,000 EV market in India, which is currently dominated by Tata Motors and MG.

Tesla’s Approach in India: Adjusting to Regional Conditions

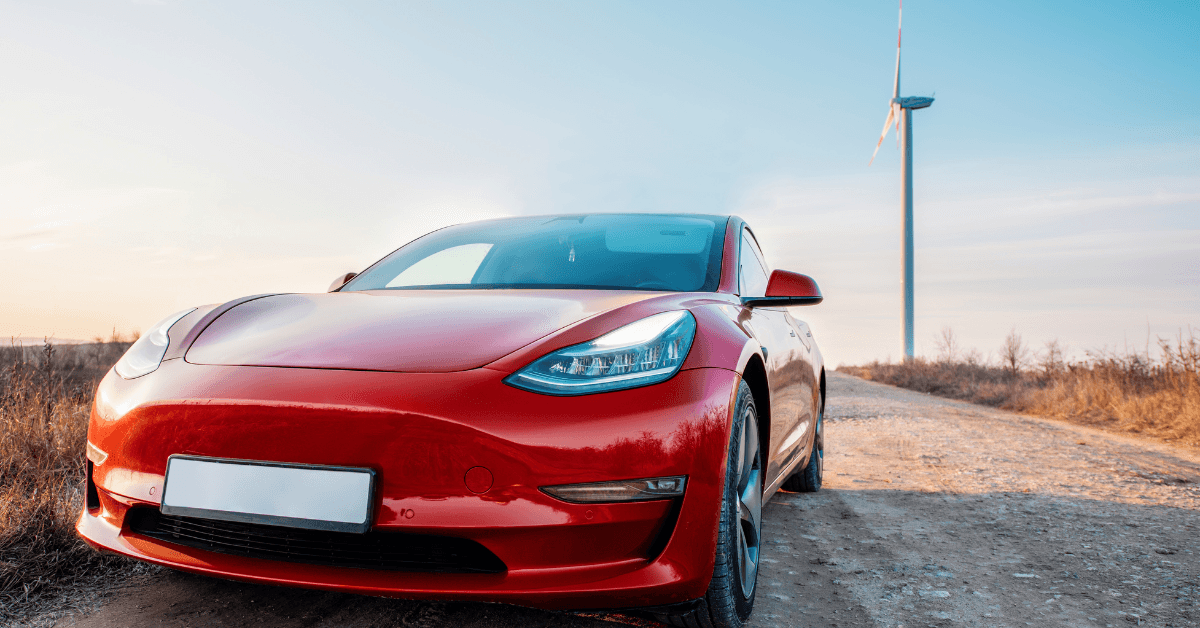

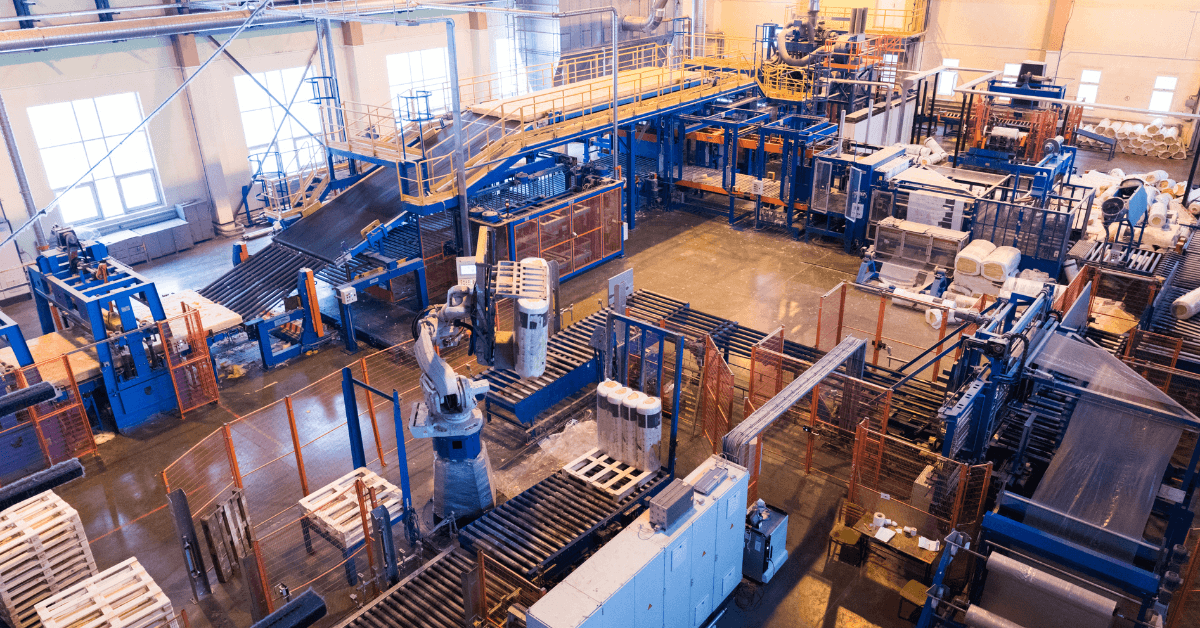

Since 2021, Elon Musk has made vague references to Tesla’s aspirations for India, but development has been sluggish. Recent discussions about constructing a plant in Gujarat or Maharashtra demonstrate their seriousness. By avoiding India’s high 100% import tariff on premium EVs, local manufacture will increase the accessibility of Tesla vehicles.

Price changes: The Model 3, which is Tesla’s most economical vehicle, is around $40,000 GLB.

I n I n d i a, t h i s p r i c e c o u l d a l i e n a t e b u d g e t − c o n s c i o u s b u y e r s.

40,000 worldwide. This price may alienate budget-conscious buyers in India. Rumored for 2025, a 25,000 small EV could be more in line with local expectations.

Infrastructure for Charging: With just 2,000 public stations spread across the country, India has a small charging network. This gap may be filled by Tesla’s Supercharger network, but collaborations with Indian energy companies like Tata Power or Reliance would be essential.

Government Relations and Regulatory Obstacles-Tesla India Market Research

The regulatory environment in India is complicated. Conflicting rules and bureaucratic bottlenecks cause confusion even as the government encourages EVs. These difficulties are exemplified by Tesla’s 2021 dispute over import tariffs.

Policy Support: EVs under $21,000, excluding Tesla’s present portfolio, are eligible for incentives under the FAME II subsidy. Securing state-level incentives or pushing for regulatory changes might make entrance easier. EV firms are already eligible for tax reductions from states like Telangana and Karnataka.

Local Sourcing Regulations: For international automakers, India requires 50% local sourcing. For components and batteries, Tesla has to work with domestic vendors. Businesses like Amara Raja and Exide may end up becoming important partners.

Consumer Behavior: What Are the Desires of Indian Customers?

Indian buyers place a high value on mileage, cost-effectiveness, and post-purchase support. According to a JMK Research report from 2023, 68% of EV purchasers rank affordability as their main concern.

Brand Perception: Although urban elites find Tesla’s luxury image appealing, widespread acceptance necessitates repositioning. Marketing initiatives that highlight long-term fuel and maintenance savings may draw middle-class consumers.

Battery Issues: Because of India’s great distances and unpredictable power sources, range anxiety endures. Extreme heat and dusty conditions, which are common in places like Rajasthan and Maharashtra, need Tesla’s cutting-edge battery technology to adapt.

Competitive Environment: Regional Powerhouses and International Rivals-Tesla India Market Research

India’s EV market will not be exclusively available to Tesla. Ola Electric, Mahindra, and Tata Motors are examples of domestic companies that are expanding quickly.

Tata Motors: With a 68% market share in 2023, the Nexon EV leads EV sales in India. One major obstacle is Tata’s extensive distribution network and knowledge of regional preferences.

Ola Electric: India’s transition to electric two-wheelers is best represented by Ola’s S1 Pro scooter. Targeting Tesla’s aspirational audience, the business intends to introduce an electric vehicle priced around $10,000 by 2024.

Global competitors like Hyundai (Kona Electric) and BYD (e6) are becoming more and more popular. Lessons in product line diversification may be learned from BYD’s emphasis on commercial cars

Sustainability Collaboration: Complementing India’s Green Objectives

EVs are essential to India’s goal of having net-zero emissions by 2070. National priorities are ideally aligned with Tesla’s objective to develop sustainable energy.

Solar Integration: In 2023, India’s solar capacity exceeded 70 GW. This expansion might be complemented by Tesla’s Powerwall batteries and solar roofing, particularly in rural regions with unstable grids.

Battery Recycling: Tesla’s closed-loop recycling method may lessen reliance on imported resources as lithium imports increase. Working with firms like Attero or Log9 Materials would strengthen this ecosystem.

The Path Ahead: Crucial Suggestions for Tesla

Locate Early: Create industrial facilities to cut expenses and win over the government.

Create Adaptable Models: To compete with Tata and Mahindra, aim for the $20,000–$20,000–$30,000 market.

Leverage Partnerships: Work together with Indian companies to provide chains for batteries and charging infrastructure.

Educate Customers: Start initiatives to debunk misconceptions around EV upkeep and performance.

Conclusion: An Expensive, Expensive Bet

The EV industry in India has enormous potential, but it also requires flexibility and patience. The key to Tesla’s success is striking a balance between its premium philosophy and the cost-conscious realities of India. In the fifth-largest economy in the world, Tesla has the potential to revolutionize mobility by embracing localization, cultivating partnerships, and inventing for affordability.

Competitors are not waiting; the time is rapidly approaching. Will local champions continue to lead, or will Tesla electrify India? Strategic agility will drive the decision.

FAQ:

Is there a market for Tesla in India?

- Yes, but there are difficulties. India’s demand for EVs is rising quickly, although price is still the main factor. Tesla’s premium price turns off purchasers on a tight budget. Strategic localization and less expensive models could unlock its potential.

Does Tesla do market research?

- Of course. Before entering a market, Tesla thoroughly researches it. The business considers consumer preferences, competitors, and laws. Recent studies extensively analyze Indian income levels and charge practices.

Will Tesla ever come to India?

- Most likely. Tesla interacts with India on a regular basis. High import duties delay entry, but local industries might fix this. Talks between Gujarat and Maharashtra suggest that improvement is likely.

Are Tesla cars allowed in India?

- Indeed, imports are subject to full duty. Teslas are currently only available to upscale consumers. Local production could avoid tariffs, but it still requires partnerships and governmental permits.

Who is bringing Tesla in India?

- Negotiating state agreements, Tesla spearheads its entry. According to reports, factories should be located in Gujarat or Maharashtra. Possible alliances with Tata or Reliance could accelerate infrastructure development.